BTC Price Prediction: Institutional Demand and Technical Strength Point to New Highs

#BTC

- BTC trades above 20-day MA, signaling bullish momentum.

- Institutional holdings surge 83%, underpinning demand.

- MACD divergence suggests short-term consolidation before upward move.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

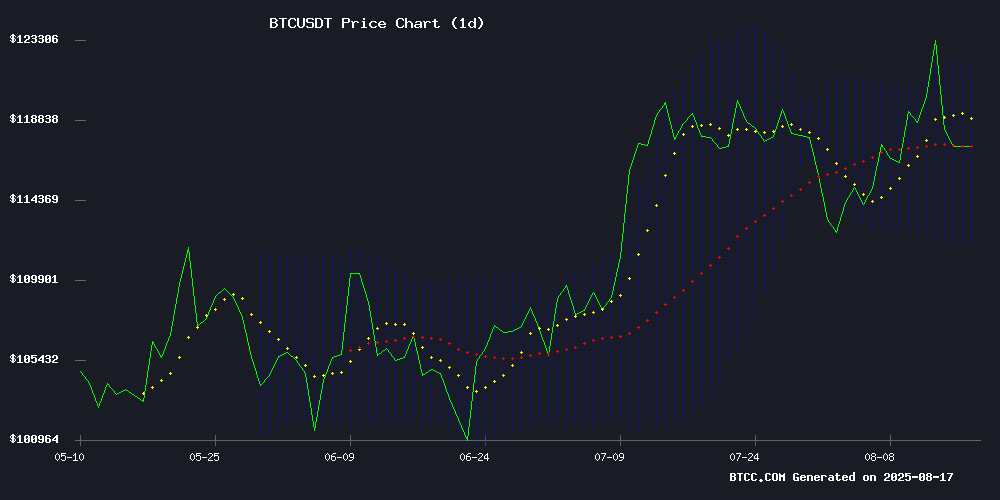

BTC is currently trading at 118,097.76 USDT, above its 20-day moving average of 116,946.51, indicating a potential bullish trend. The MACD shows a bearish crossover but with narrowing momentum, while Bollinger Bands suggest a neutral to slightly bullish range between 112,008.41 and 121,884.61. Analyst Ava from BTCC notes that if BTC holds above the 20-day MA, it could target 125,000 USDT in the NEAR term.

Institutional Adoption and Market Sentiment Boost BTC Outlook

Recent news highlights significant institutional interest, with NBIM increasing Bitcoin holdings by 83% in Q2 2025. Altcoin market cap against BTC suggests upside potential, and debates about Bitcoin's cycle peak are reigniting. Despite short-term volatility, structural strength is evident. Analyst Ava from BTCC emphasizes that institutional accumulation and positive sentiment could drive BTC toward new highs by year-end.

Factors Influencing BTC’s Price

NBIM Expands Bitcoin Holdings by 83% in Q2 2025, Signaling Institutional Crypto Adoption

Norway's sovereign wealth fund, NBIM, has aggressively increased its Bitcoin exposure, adding 5,200 BTC to reach a total holding of 11,400 BTC. The 83% quarterly surge reflects a strategic pivot toward cryptocurrency through equity positions in treasury-focused firms like Strategy (formerly MicroStrategy) and Metaplanet.

Standard Chartered's analysis reveals NBIM's concentrated bet on Strategy—which holds 628,946 BTC worth $74 billion—while allocating a modest 200 BTC-equivalent to Metaplanet. "This isn't passive accumulation," notes Geoffrey Kendrick, the bank's digital assets research head. "An 83% hike in one quarter demands intentional positioning."

The MOVE aligns with a broader institutional trend: K33 Research reports NBIM's indirect BTC exposure grew 192% year-over-year through H1 2025, fueled by corporate treasuries diversifying into digital assets. Strategy remains the gold standard for public companies, with Metaplanet ranking seventh at 18,113 BTC.

Altcoin Market Cap Against BTC Signals Strong Upside Ahead, Reaching 0.13 Level

Altcoins are flashing bullish signals as their aggregate market capitalization against Bitcoin bottoms out at a critical level. The BTC/Altcoins chart, which tracks the performance of alternative cryptocurrencies relative to Bitcoin, has dipped to 0.13—a historical support zone that previously preceded massive rallies. The last time this level was tested in 2021, it ignited one of the most explosive altseasons on record.

Technical indicators now suggest a repeat may be imminent. A pronounced bullish divergence has emerged, with price action trending downward while momentum indicators climb—a classic reversal signal. Trading volume remains elevated NEAR these levels, suggesting accumulation by strategic buyers rather than distribution. "The altcoin market capitalization valued in BTC has bottomed and shows strong bullish divergence," noted analyst Michael Van de Poppe. "This indicates significantly more upside ahead."

Bitcoin Cycle Peak Debate Reignites as Analyst Projects December 2025 Top

A widely circulated cycle model suggests bitcoin may approach its bull market ceiling by December 2025, with a projected peak near $200,000. The analysis aligns historical patterns showing each cycle lasting longer than its predecessor, now extending to 37 months from November 2022's low.

Veteran trader Peter Brandt offers a counter-narrative, assigning 30% probability that BTC already peaked. His risk scenario envisions a retreat to $60,000-$70,000 by November 2026 before a potential parabolic rally toward $500,000. Market participants now weigh these divergent timelines against Bitcoin's current $117,000 price action.

Bitcoin's Broad Participation Signals Structural Strength Amid Price Volatility

Bitcoin approaches $124,000 with widespread holder participation, as indicated by a declining Age Cohort Concentration Index (HHI) since April. This metric suggests a more sustainable bull trend compared to rallies dominated by a single group. The cryptocurrency recently tested resistance near $124,000 after rebounding from $117,000, with moving averages and MACD signaling bullish momentum.

Despite positive indicators, repeated rejections at the upper channel boundary reveal persistent selling pressure. The 90-day correlation between BTC's log-price and HHI shows early signs of recovery from historically low levels, reinforcing the significance of broad-based participation in this rally.

Traders remain cautious as Bitcoin continues to trade within an ascending channel pattern established since April. The market watches for either a decisive breakout or further consolidation near current resistance levels.

Bitcoin And Crypto Market To Crash? Analyst’s August-September Prediction

Bitcoin and the broader crypto market may be following historical post-halving patterns, with a potential September crash looming. Analyst Benjamin Cowen's technical analysis suggests that while July and August often bring rallies, September has repeatedly marked a downturn before a final cycle peak later in the year.

Historical fractals from 2013, 2017, and 2021 show striking similarities: bullish momentum in mid-summer followed by a sharp correction. This cyclical behavior raises questions about whether 2024 will mirror past trends. The market's resilience in July and August could be setting the stage for another September shakeout.

Cowen's chart analysis underscores the seasonal nature of Bitcoin's price action. The consistency across multiple halving cycles adds credibility to the pattern. Investors are watching closely to see if history repeats, with the fourth quarter potentially offering a recovery window.

Bitcoin Whale Resurfaces After 5 Years, Moves $353 Million in BTC

A dormant Bitcoin whale holding 23,969 BTC ($2.82 billion) suddenly transferred 3,000 BTC ($353.16 million) to a new wallet on August 16, 2025. The move, tracked by Lookonchain, marks the first activity from this entity in half a decade.

Market participants are speculating whether this signals impending volatility. Historical patterns suggest large holders often redistribute assets during bullish conditions to capitalize on price appreciation. The timing coincides with Bitcoin's recent rally, though the whale's ultimate intent remains unclear.

Bitcoin Shows Indecisive Momentum Amid Geopolitical Developments

Bitcoin's recent trading session closed with a slight bearish bias, though market analysts remain cautious in interpreting the signal as decisively negative. The cryptocurrency's daily candle reflected modest downward pressure, yet the broader trend remains ambiguous—a characteristic hesitation in volatile markets.

Geopolitical winds may soon shift the landscape. The productive meeting between US President Donald Trump and Russian President Vladimir Putin has injected a note of Optimism into risk assets. Historically, such diplomatic progress tends to buoy investor sentiment, potentially creating tailwinds for Bitcoin if stability persists.

Beneath the surface, traditional markets flash warning signs. A bearish weekly close in equities serves as a reminder that macro uncertainties linger. For crypto traders, this duality demands vigilance—even promising geopolitical developments can't fully offset systemic risks brewing elsewhere.

Taiwan's Top Win International Launches $10M Bitcoin Treasury Strategy

Top Win International has become Taiwan's first publicly listed company to adopt a Bitcoin treasury strategy, raising $10 million for BTC acquisitions. The August 15 announcement follows a global trend of corporations adding cryptocurrency to balance sheets, with the firm's stock initially spiking 50% before settling at a 12.5% pre-market gain.

Fintech partner WiseLink anchored the raise through convertible notes, while United Capital Management's Chad Koehn joined private investors. The capital allocation prioritizes Bitcoin purchases, reserving a portion for operational needs. Market response remains bullish despite volatility, with Top Win's shares up 51% year-to-date.

Galaxy Digital Secures $1.4B Loan To Convert Helios Mining Facility To AI Data Center

Galaxy Digital has secured a $1.4 billion loan to repurpose its Helios Bitcoin mining facility into an artificial intelligence data center. The move aligns with the firm's long-term agreement with GPU provider CoreWeave Inc., marking a strategic pivot toward AI infrastructure.

The loan facility will cover 80% of the construction costs for the first phase of the project, with Galaxy providing $350 million in equity. Helios, located in West Texas, is expected to begin delivering power for AI operations by early 2026. CEO Mike Novogratz emphasized the project's role in diversifying Galaxy's business beyond crypto.

Bitcoin’s Endgame: Network Sustainability Post-2140 Mining Completion

Bitcoin’s fixed supply of 21 million coins will be fully mined by 2140, eliminating block subsidies that currently incentivize miners. Experts from OKX Singapore, JuCoin, and XBO suggest the timeline allows adequate preparation for a fee-driven security model. Transaction fees must compensate for lost subsidies to maintain network integrity.

Gracie Lin, CEO of OKX Singapore, highlights the critical shift: "Bitcoin’s security will depend fully on transaction fees." The central challenge lies in scaling demand for block space to justify premium fees. Institutional adoption and retail activity are projected to fill this gap—if growth trajectories hold.

Concerns linger over potential centralization risks and the network’s adaptability. The halving mechanism, which periodically reduces mining rewards, has historically reinforced Bitcoin’s scarcity. Yet its long-term viability now hinges on organic fee market maturation—a test of economic design unprecedented in monetary history.

Institutional Bitcoin Holdings Near 20% Of Supply—Wall Street’s New Playground

Bitcoin is undergoing a structural transformation as institutional investors tighten their grip on the cryptocurrency. By mid-2025, these entities are emerging as a dominant force, capturing a significant portion of Bitcoin's circulating supply.

Recent data reveals that institutions—spanning ETFs, public companies, and governments—now control between 17% and 31% of Bitcoin's total supply. Collectively, they hold over 3.642 million BTC, valued at approximately $428 billion. ETFs lead the charge with 1.49 million BTC, while public companies like Strategy and Tesla account for 935,498 BTC. Strategy's aggressive accumulation strategy stands out, with the firm amassing 628,946 BTC, or roughly 3% of the circulating supply.

Private companies hold an additional 426,237 BTC, worth $50.17 billion. The trend underscores Wall Street's growing appetite for Bitcoin as a treasury asset, signaling a seismic shift in its role within global finance.

How High Will BTC Price Go?

Based on technical and fundamental analysis, BTC could rally to 125,000 USDT in the near term, with potential for 150,000 USDT by December 2025 if institutional demand persists. Key levels to watch:

| Support | Resistance |

|---|---|

| 112,008 (Bollinger Lower) | 121,884 (Bollinger Upper) |

| 116,946 (20-day MA) | 125,000 (Psychological) |